Need help after a calamity? Here’s how to apply for the SSS Calamity Loan 2025 online. Step-by-step guide, eligibility, deadline, and FAQs inside.

📌 How to Apply for SSS Calamity Loan 2025 (Step-by-Step Guide)

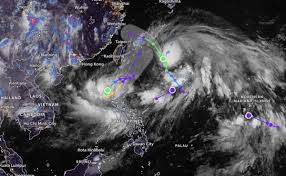

Are you affected by recent typhoons or floods in the Philippines? Good news—SSS Calamity Loan 2025 is now available to help qualified members recover financially. This guide explains everything you need to know, from eligibility, requirements, how to apply online, and the loan deadline.

🔍 What is the SSS Calamity Loan?

The SSS Calamity Loan Assistance Program (CLAP) is a financial aid program by the Social Security System (SSS) for members living in areas officially declared under a State of Calamity.

This loan is meant to help you rebuild after:

- Typhoons

- Floods

- Earthquakes

- Other natural disasters

✅ Who Can Apply?

To qualify for the SSS Calamity Loan 2025, you must:

- Be an active SSS member

- Have a My.SSS online account

- Reside or work in an area declared under a State of Calamity

- Have at least 36 posted monthly contributions, with 6 contributions in the last 12 months

- Have no outstanding SSS loans (e.g., salary loan, previous calamity loans)

📄 Required Documents

You don’t need to go to an SSS branch. Just prepare:

- My.SSS account

- Valid ID (if required during verification)

- Proof of residence in the calamity area (for some applicants)

- Bank account enrolled in SSS for loan disbursement (e.g., via PESONet, GCash, or UnionBank)

🖥️ How to Apply Online for SSS Calamity Loan

Step-by-Step Process (2025)

- Go to https://member.sss.gov.ph

- Log in with your My.SSS username and password

- Click “E-Services” > “Apply for Calamity Loan”

- Fill out the online form with your correct information

- Select your preferred disbursement channel

- Submit and wait for approval via email or text

✅ No need to visit SSS branch! Entire process is online.

💰 How Much Can You Borrow?

Loan amount depends on your average monthly salary credit (MSC), usually:

- ₱5,000 to ₱20,000+

Loan Terms:

- Payable in 24 months

- Interest rate: 10% per annum

- First payment due: Second month after release

🗓️ What’s the Deadline?

The deadline to apply is usually within 90 days after the calamity declaration by the local government (LGU) or the NDRRMC.

📌 Always check the latest updates on the SSS Facebook page or official website.

❓ Frequently Asked Questions (FAQ)

🔸 Is there a processing fee for SSS Calamity Loan?

No. There are no processing fees for applying.

🔸 Can I apply if I already have a salary loan?

No. You must fully pay any existing loans before applying.

🔸 How long before I get the money?

Approval usually takes 3–5 business days, and money is credited to your enrolled bank or mobile wallet.

🔸 Can OFWs apply?

Yes, if you’re an SSS member and your registered home is in a declared calamity area.

🧭 Final Tips

✔ Keep your My.SSS login details safe

✔ Make sure your contact info and bank account are updated

✔ Track your application through your My.SSS account

📢 Stay Informed, Stay Safe!

If you or your loved ones are affected, don’t delay your application. The SSS Calamity Loan 2025 can provide much-needed financial support.

🥣 Bonus from PinoyPanlasang.org:

While waiting for your loan approval, check out our comforting rainy day recipes like: